Paying the piper

Higher real interest rates are coming. Today, the 10-year Treasury yields 1.78% and CPI is 7.5% so the real rate is negative 5.72%. Over the coming cycle, the real rate can increase to over positive 5%. In the new environment, asset prices will decline, prudence will be rewarded, and profligacy punished.

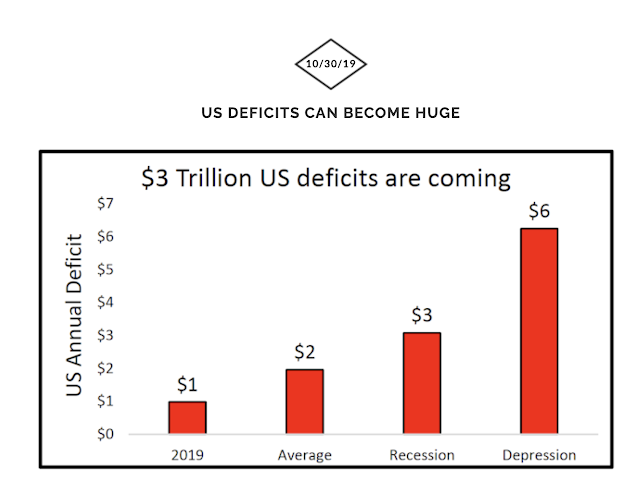

US Deficits are going to soar.

In 2019, the US federal government deficit was $1 Trillion. At the time, I predicted deficits would increase to $3 Trillion with the possibility of much larger deficits. I was almost exactly correct as the 2020 deficit did hit $3 Trillion. Much larger deficits are likely.

How did I predict the soaring deficit? Did I predict Covid or the Russian invasion of Ukraine? No. Larger deficits were inevitable because the factors restraining deficits were temporary. (See "HUGE DEFICITS".)

What is next for the US economy? The answer is a negative cycle where higher deficits lead to higher real interest rates, which in turn lead to high deficits. This process will be extremely unpleasant for borrowers, and for people who have taken too much financial risk.

February 2022 performance

The Dow Jones Industrial Average lost 3.19% in February 2022 while the Chicken Little portfolio gain 1.58%. Year to date, Chicken little has squeaked out a positive seventy seven basis points, while the Dow has lost over 6%

February 2022 was a negative month for most risky assets. Crypto and gold were the two winners while stocks and bonds declined around the world. Year to day, gold is the only winner.

March 2022 portfolio position

The Chicken Little Portfolio is prepared for financial disaster. The portfolio benefits from stock market declines and has minimal exposure to any risk.

93% of the portfolio is in cash or relatively short-term US Treasuries. Even though Chicken little remains 100% negative on stocks, the short position was reduced on Feb 24 to manage risk (see "still uber bearish.")

Why do you think real interest rates have to go up? Why wouldn't they "print" and suppress rates rather than having a huge interest expense?

ReplyDeleteHi Charles, my view is that the Fed now cares more about inflation than keeping rates lower. So they are making the choice that is best for them, regardless of whether it is better for you and me. Terry

Delete