My thoughts on Greek debt.

1. Greece is not going to repay its debt.

2. Germany/Europe can afford to pay Greece's debt.

3. Greece's debt is a political crisis, not an economic crisis.

|

| Trouble in Greece |

Snapshot of Greece's financial situation:

2015 Greek GDP: $252 Billion

2015 Greek Debt: $432 Billion.

Interest on Greece's debt at current market interest rate, $54 Billion

At market rates, the interest on Greece's debt would be 20% of GDP. That is roughly equal to all US Federal government spending. Greece cannot even pay the interest on its debt, let alone pay off what it owes.

|

| Greece cannot pay its debts |

2. Germany/Europe can afford to pay Greece's debt.

Germany spent approximate $1.9 trillion on reunification with former East Germany. The 2014 German budget has a surplus of $20 billion. Germany's surplus stands in sharp contrast to government deficits in the U.S., Japan, and many other parts of Europe.Germany could pay off the Greek debt of $432 billion.

Even simpler than having Germany pay would be to use the European Central Bank (ECB). In the European version of Quantitative Easing, the ECB is buying $70 billion a month in European assets. Greek debt is approximately six months of this European version of electronically printing money.

|

| Mario Draghi (ECB) or Angela Merkel (Germany) could pay Greece's debt |

3. Greece's debt is a political crisis, not an economic crisis.

Germany or the ECB could solve the entire Greek debt problem. Even easier would be for German/Europe to give Greece a few billion dollars to push the problem out until 2016. The price for extension is relatively inconsequential. Consider that just today (June 22, 2015), the value of Deutsche Bank stock increased by more than $1.5 Billion dollars on the possible news of a Greek deal.The short-term benefits to a deal dwarf the short-term costs.

Why is Germany risking ruin for a trivial amount of money? First, the Greek government continues to insult the German government.

|

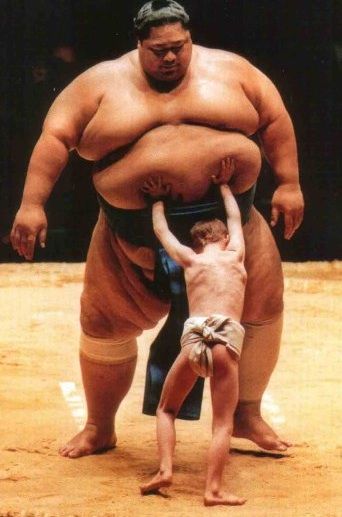

| Greek Finance Minister Yanis Varoufakis claims this image is doctored; the spirit of the image is accurate. |

|

| Italian debt exceeds $2 trillion |

What is going to happen? There are no good options for Greece. The question is what is the best bad idea (see video clip from the movie Argo)?

No comments :

Post a Comment