In 1958, AW Phillips created the 'Phillips Curve' concept that central banks could print to create a bit more employment at the expense of a bit more inflation. Recently, central banks tried to print a lot more employment, and argued that the 'Phillips curve is not dead." - see Jerome Powell's 2018 article favoring printing. Unfortunately, the mistakes of Central Bank overprinting threaten all of us.

November 2021 performance

The Dow Jones Industrial Average lost 3.48% in November 2021, giving back much of October's gain. Chicken Little's portfolio lost 0.10%.

November was a tough month with all major asset classes except Treasuries losing money. Perhaps surprisingly for American investors in Apple and other US big cap tech stocks, 2021 has been disappointing. Stocks outside the US are flattish with emerging market stocks down and European stocks up modestly. Both gold and bonds have lost money year to date. Big cap tech and crypto are winners.

What is the impact of Central Bank printing?

Camus wrote, "There is but one truly serious philosophical problem, and that is suicide." When it comes to investing, the only truly serious question is what is the impact of central bank printing?

To recap the hard-to-grasp magnitude, The Fed printed $1 trillion dollars in its first century, and then printed $8 trillion in a decade.

There are two salient possible outcomes of central bank monetary looseness.

-> 1. The critics of loose monetary policy are correct. There is no Phillips curve. Loose money leads to financial destruction and social unrest.

-> 2. The proponents of MMT, modern monetary theory, are correct, and printing money makes the economy stronger.

As an investor, I believe you have to pick a side as there is no portfolio that can reasonably be expected to do well in both worlds. Chicken Little believes that loose money kills. Thus, all asset prices are at risk and the best approach is to huddle in cash and be ready to re-allocate.

December 2021 Portfolio Position

Chicken Little continues to hide in cash.

|

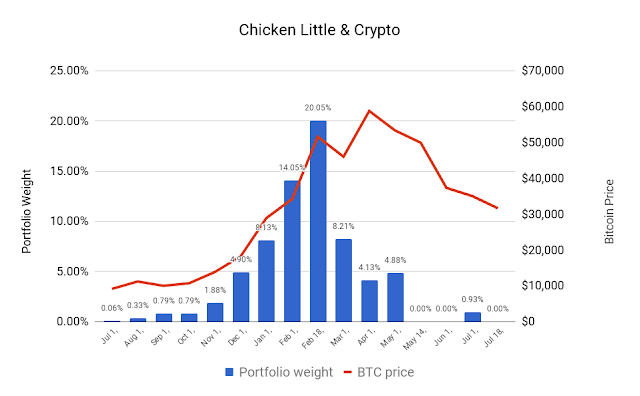

| Chicken Little has jumped in and out of crypto |

Crypto has been as much as 20% of the Chicken Little Portfolio (Feb 18, 2021) and as low as 0%. This oscillation caused by uncertainty regarding crypto. Specifically, is crypto a risk asset being levitated by easy money, or a safety asset to protect against fiat currency debasement?

The answer is that crypto is both a risk asset and a safety asset. However, at least in the medium term, Chicken Little believes that crypto prices will fall along with stocks. Accordingly, Chicken Little has reduced the crypto position to 1.5% - half of what it was a month earlier.

No comments :

Post a Comment