The party in the stock market continues. Interest rates have gone up significantly, but the stock market also continues to rally. Does Chicken Little have tiny, poorly-functioning bird brain?

|

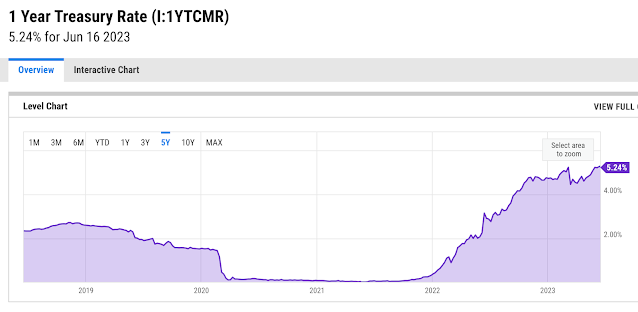

| Nominal interest rates are at multi-year highs |

Is the Fed competent after all?

The stock market continues to rally relentlessly. This rally in the stock market is happening even while interest rates have risen dramatically. I have always predicted an end to the party when interest rates rally. I can think of three possible explanations for the current ebullience in the stock market.

#1: Inflation-adjust real rates are still low. In the last 12 months, prices have increased 4-6% in the US depending on which measure is used (Consumer Price Index, GDP deflator, core, etc.) A 5% interest rate on short term US treasuries or 4% on longer-term treasuries is still close to a 0% real inflation rate.

#2: The end is coming, but the market needs one more crazy rally before the end.

#3: Central Banks are all correct. By increasing interest rates, and shrinking their balance sheets a bit, they have unwound the excesses from years of loose money.

I believe it is some combination of #1 and #2. The end is still coming and real interest rates will go significantly higher.

May 2023 performance

Chicken Little is invested in treasury bills. There will be no big swings in portfolio value. In May, the Chicken Little Portfolio gained 32 basis points while the The Dow Jones Industrial Average lost 3.14%.Year to date, Chicken Little is up 1.29%, and the Dow has risen 0.24%.

May 2023 was a modestly negative month for all assets. However, year to date, stocks, bonds, and crypto are all up.

June 2023 portfolio position

The Chicken Little Portfolio remains prepared for financial disaster. No trades in the month of May so we start June precisely where we started May. T-bills for Chicken Little these days.

No comments :

Post a Comment