Fire in the Bond Market

Early on April 9, 2025 global bond prices were plummeting, and stock markets were set to crash. Hours later, President Trump paused tariffs; the bond market recovered and global stock markets soared. The Wall Street Journal reported that the bond market influenced President Trump, "I saw last night where people were getting a little queasy.”

Bond prices are paramount

Interest rates are central to the economy. In short, bonds are more important than stocks. This was reinforced in April.

No.

Immediately after the Liberation Day tariffs were announced, the US stock market lost $6 trillion in value. Asked if he wanted stock prices to decline, President Trump responded with, "I don't want anything to go down. But sometimes you have to take medicine to fix something.

Sanguine about stock market declines, President Trump announced the tariff pause within hours of the bond market rout.

Why are interest rates so important -- so important that they influenced President Trump? The answer is that higher interest rates cause the economy to slow down. Mortgages, car loans, corporate borrowing all become more expensive when bond prices decline.

Furthermore, all asset values decline with rising real (inflation-adjusted) interest rates. "Duration" is defined as the sensitivity of an investment to changes in interest rates. For every 1% rise in real interest rates, an asset's value drops by 1% times its duration.

The US stock market has a duration of approximately 25 years. So a 1% rise in real interest rates causes a 25% decline in stock market values. Thus, apparently small changes in real interest rates have enormous implications for the economy.

The bond market rout was set to cause a slowdown in the US economy, and a significant decline in the prices of houses, stocks, and other assets. Now that the tariffs are paused and stock markets around the world are much higher, can we relax?

Real Interest Rates will rise

Interest rates are central to an economy, and rising real rates spell trouble. Regardless of who is President, and independent of any tariff policy, US real interest rates are going to rise. The consequence is going to be a pervasive change in the US economy, and society more generally.

The real interest rate is the "nominal' interest rate minus the inflation rate. For the United States, I use the 10-year US Treasury bond yield for the nominal interest rate and the Consumer Price Index (CPI) to measure inflation. (There are other ways to calculate real rates, and they all paint the same picture.)

The real rate today in the US is 1.56%. The average 10-year Treasury bond yield so far in 2025 is 3.95%, and the most recent CPI calculates prices having risen 2.39% over the last year.

Real interest rates are going to rise from the current 1.56%. Why? The current rate is historically low, still recovering from the Federal Reserve's disastrous decision to electronically print enormous sums of dollars.

Post WWII real interest rates

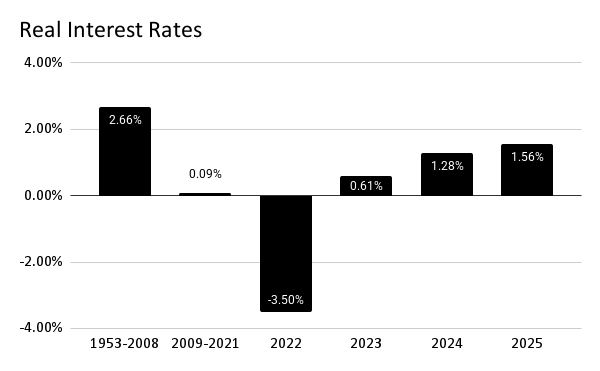

The following chart shows real US interest rates from 1953-2025. I divided the data into periods based on important macroeconomic events.

1953-2008: "Normal" times

Real interest rates averaged +2.66% between 1953 and 2008 (the beginning of the housing crisis). A real interest rate of somewhere around 3-5% is consistent with many long-term averages in a range of countries.

2008-2021: The Grand (failed) experiment

US (and global) governments sought to cushion the impact of the housing crisis. Consequently, the US government undertook historic approaches to both fiscal and monetary policy.

First, the US government ran historically large budget deficits. The post-2008 deficits were never before seen in peacetime. The large deficits led to US debt-to-GDP levels that are at or above the highest levels in history.

What happened to real interest rates during this experiment of novel, large peacetime US federal deficits? Without any other action, the expectation is that US government would have to pay high interest rates to sell the large quantity of Treasuries.

Consider that the Federal Reserve was created in 1913. Between 1913 and 2008, the Fed electronically created just under $1 Trillion. Then, in an historically unprecedented move, the Fed created an additional $8 trillion in new money.

However, the US Federal Reserve undertook historically loose money that delayed the cost of the US government overspending. The Fed created 8 times as much new money since 2008 as it had in the prior century: The mother of all monetary bubbles (at least for the US).

|

| The Fed e-printed trillions |

Federal Reserve printed money and kept short-term interest rates low. From 2009-2021 the average real interest rate was 0.09%.

What happens with 0% interest rates? A crazy world. Housing prices soared, stock prices rose to historic levels, and the ultra-loose money created the greatest inflation in a half century.

2022+: The Hangover

As a consequence of the Fed's loose monetary policy, inflation soared. The Fed began trying to undo its mistakes beginning in 2022 by raising some interest rates, and selling some of its bonds.

Thus, I continue to predict rising real interest rates, lower asset prices, and turmoil.

Where does it end?

I continue to believe that real interest rates will continue to rise, and will peak significantly above the 2.66% average between World War II, and the twin mistakes of overspending an overprinting. We are going to have to pay for the strange period of zero real interest rates and massive government overspending.

April 2025 Performance

The Dow Jones Industrial Average lost 3.17% in April 2025. The Chicken Little Portfolio gained 0.23%. Through the end of April, the Dow has lost 4.08% while the Chicken Little Portfolio has gained 1.59%

April 2025 was a wild month for investors, but ended up almost unchanged for a variety of investments. US stocks and Treasury bonds lost money, while stocks outside the US had modest gains. Bitcoin and gold had good months. Year to date, gold remains the best performer with a gain of over 25% in the first four months of 2025.

May 2025 portfolio position

Chicken Little covered the short position in stocks in April 2025. I still believe the end is coming soon for stocks, but investments do not go in a straight line. Stocks began to rally strongly in recently weeks after about a 20% decline (depending on what index one examines).

In addition, I have added to my long-term US Treasury bond position. This may seem odd given that my #1 prediction is rising real interest rates. Why buy bonds if one predicts rising rates? Two answers. First, oil is now at $58/barrel and, more generally, I am in the deflation camp. Rising real rates can be accomplished by deflation without rising nominal rates.

Second, I would like to own a lot of Treasury bonds, so I am underweight relative to where I would like to be given my age, and the fact that I live in California. Treasury bonds are not taxed at the state level, so the higher one's state tax rate, the better the income from US Treasuries.

Long-term treasury bonds are obviously riskier that shorter-term bonds. However, with a 5% yield on a tax-advantaged investment, bonds do not seem ridiculously over-priced.

When long-term Treasuries yielded 1%, I sold the last of my holdings. See my blog posts selling bonds:

The TLT is an ETF for Long-term US Treasury bonds. The TLT maximum price was $179.70 in March 2020. The price today is $87.13 - more than a 50% decline. I sold part of my long-bond position in 2019 in the $140s. Then I sold the last of the long-term Treasuries in March of 2020 in the high $160s. I have re-purchased part of my long-bond Treasuries at prices below $90.

Obviously, the TLT can go much lower than the current price of $87.13. The fact that bonds have been destroyed, doesn't mean they won't be destroyed even more. In short, even at 50% off from highs, long-term US Treasuries are still risky.

However, having dodged a 50% decline in the price of long-term US Treasuries, I am okay holding some bonds at 5% yield, while acknowledging the risks.

No comments :

Post a Comment